The No.1 Central Document of 2024 proposes to promote precise insurance coverage and claims settlement for agricultural insurance, ensuring that all claims are fully compensated. With the advancement of the rural revitalization strategy, the demand for agricultural and rural risk protection and financial services is increasing day by day, and the technological content of agricultural insurance is also constantly increasing. MINTAIAN actively responds to national policies, strives to explore "public assessment+technology", and is committed to improving its technological service capabilities, enhancing the comprehensiveness, efficiency, scientificity, and accuracy of agricultural insurance in risk reduction and loss assessment. MINTAIAN has independently developed a new type of agricultural insurance risk reduction technology product called "Science and Agriculture Protection" through modern technological means such as multispectral unmanned aerial vehicles and satellite remote sensing analysis technology. It can provide scientific and technological services such as underwriting verification, growth analysis, disaster level classification, loss assessment and claims for agricultural insurance.

Practical achievements: In October 2024, the Agricultural Insurance Department of a branch of an insurance company commissioned a corn drought case in a certain area, with a reported loss area of nearly 100000 mu and a reported loss amount exceeding 10 million yuan.

After receiving the commission, MINTAIAN Branch quickly joined forces with the headquarters' group customer service center and technology information business department to discuss the plan. The region has geographical and climatic characteristics such as cloudy and mountainous terrain. The rainy season is from June to September every year, with cloudy and foggy weather, which is the season for crop growth. After verification by the Technology Information Business Department, it has been found that there are some commercial satellite remote sensing data that do not have valid remote sensing data in the affected areas. If only satellite remote sensing data is obtained for analysis, it is impossible to accurately determine the planting and loss situation in all affected areas.

After tripartite research, it has been decided that professional technicians in the field of agricultural insurance will carry DJI drones and adopt a combination of drones, optics, and multispectral satellite image analysis to reduce the proportion of ground manual sampling in areas with effective remote sensing data and increase the intensity of ground manual sampling in areas without effective remote sensing data. This technical plan aims to present the measurement and annotation of planting and loss situations in the reported loss areas to the fullest extent possible, while ensuring the accuracy and scientificity of the data.

The agricultural insurance ground verification team of MINTAIAN Branch worked closely with the headquarters' group customer business center and technology information business department to carry out the operation as scheduled according to the established plan, and delivered the operation results to the case client on time as agreed. The evaluation plan and results of "appraisal+technology" in this case have been fully recognized by the client.

Introduction to the "Science and Agriculture Protection" technology products independently developed by MINTAIAN:

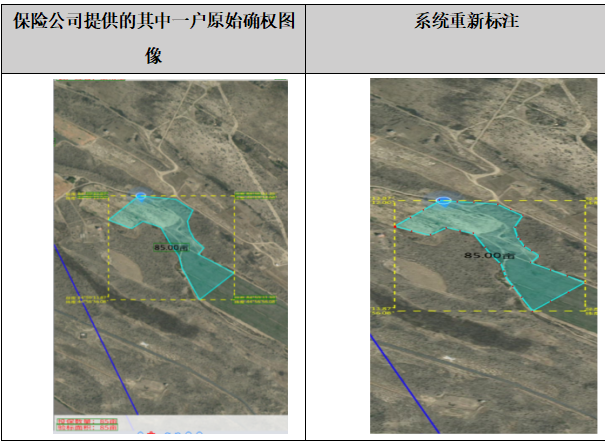

1. Underwriting verification: Underwriting verification is an important step in ensuring the validity of insurance contracts. Satellite remote sensing technology can automatically generate high-definition satellite image land distribution maps, assign standard codes to each land parcel, and effectively avoid errors in manual measurement. At the same time, through the online plot drawing function provided by the system, accurate input and modification of plot information can be achieved, further improving the accuracy of underwriting and verification targets.

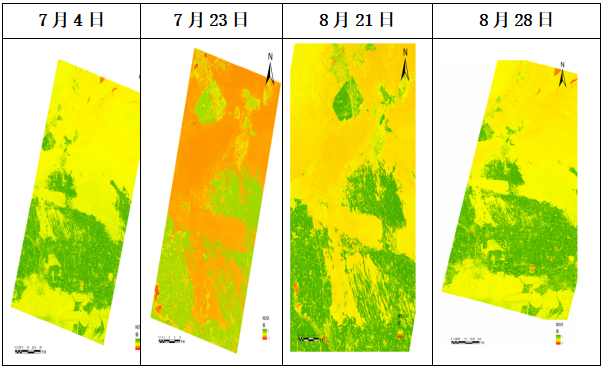

2. Growth analysis: During crop growth, satellite remote sensing technology can obtain high-frequency and large-scale image data of farmland, forming monitoring reports. By monitoring the growth process and growth of crops in the insured area, combined with multi-source remote sensing data and intelligent algorithms, the system automatically identifies disaster types and calculates remote sensing indices that reflect the degree of disaster, such as NDVI (Normalized Vegetation Index), WSI (Water Stress Index), etc. Through the analysis of remote sensing index values at the plot level, 'Science and Agriculture Protection' can effectively achieve crop growth analysis.

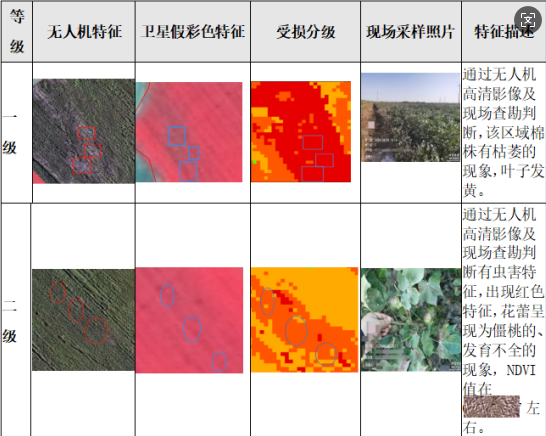

3. Classification of Disaster Levels: After a disaster occurs, "Kehu Agriculture" captures high-resolution image data of farmland through unmanned aerial vehicle multispectral and satellite remote sensing imaging technology, which can quickly obtain the disaster location of the insured area and obtain high-resolution remote sensing images before and after the disaster. Science and Agriculture Protection "can achieve monitoring and evaluation of farmland area, crop types, growth conditions, environmental conditions, and pest and disease situations, providing rich data sources for disaster level classification. Through remote sensing index value analysis at the plot level, it can achieve precise classification of crop disaster severity.

4. Loss assessment and compensation: Satellite remote sensing technology can provide a basis for evaluating the extent and severity of crop damage that is "traceable" and "evidence-based". By combining drone aerial photography, on-site visits, and other methods, insurance institutions can conduct on-site inspections and verifications of insured plots, and obtain the final crop loss situation in the insured area based on the corrected loss assessment results using comprehensive remote sensing technology. This provides insurance companies with a basis for refined loss assessment and precise claims settlement. By comparing land ownership data and underwriting information, appraisers can promptly identify and address potential fraud risks. Through property rights verification data, 'Science and Agriculture Protection' can accurately determine the affected farmers and affected areas, and make precise claims, achieving household damage assessment and claims settlement.

Kehu Agriculture "is a service product launched by MINTAIAN using multispectral unmanned aerial vehicles and satellite remote sensing analysis technology to provide technological empowerment for agricultural insurance business. It is another innovation of MINTAIAN in the field of risk reduction services. The close integration of offline survey services and online technology by appraisers has formed an integrated agricultural insurance technology service system, further demonstrating the professionalism of Mintai An's agricultural insurance technology services. In the future development, MINTAIAN will continue to deeply cultivate the field of agricultural insurance risk reduction services, continuously optimize technology products, improve technology modules such as risk investigation, risk control, and damage assessment, innovate service models, and make more positive contributions to accelerating the modernization of agriculture and rural areas.

WeChat official account

WeChat official account WeCom

WeCom